What's Prevailing Wage?

Prevailing wage refers to the rate of pay that contractors and vendors must offer employees when doing work for a government project. This pay rate is determined by the state for each project.

Prevailing wage documents can seem pretty daunting when you aren’t quite sure what you’re looking at, not to worry Trux is here to help!

Filling out Prevailing Wage Documents

To Start, all Prevailing wage jobs are marked on the Platform with a  this will let you know before taking the shift whether or not Prevailing wage will be required to be paid to your driver and if you will have to fill out these forms.

this will let you know before taking the shift whether or not Prevailing wage will be required to be paid to your driver and if you will have to fill out these forms.

When You perform prevailing wage work on the platform you will receive the required documents on the following Sunday. These documents MUST be filled out by EoD Wednesday as to not affect Payroll.

Prevailing Wage documents will change based on the state in which the work was performed and Each state (MA, RI) has different rules for how these forms must be filled out.

Massachusetts Prevailing Wage

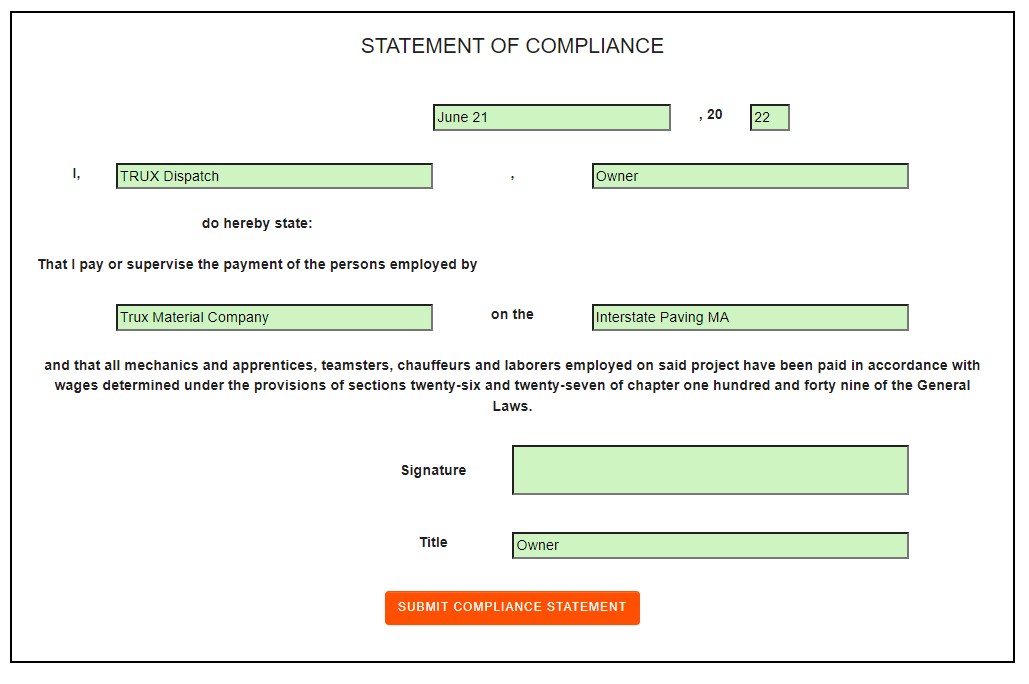

- Statement of Compliance

For the Massachusetts Statement of Compliance all boxes must be filled out in order to submit, Trux will pull most of the information from the Trux app, leaving only the signature to be filled out by you.

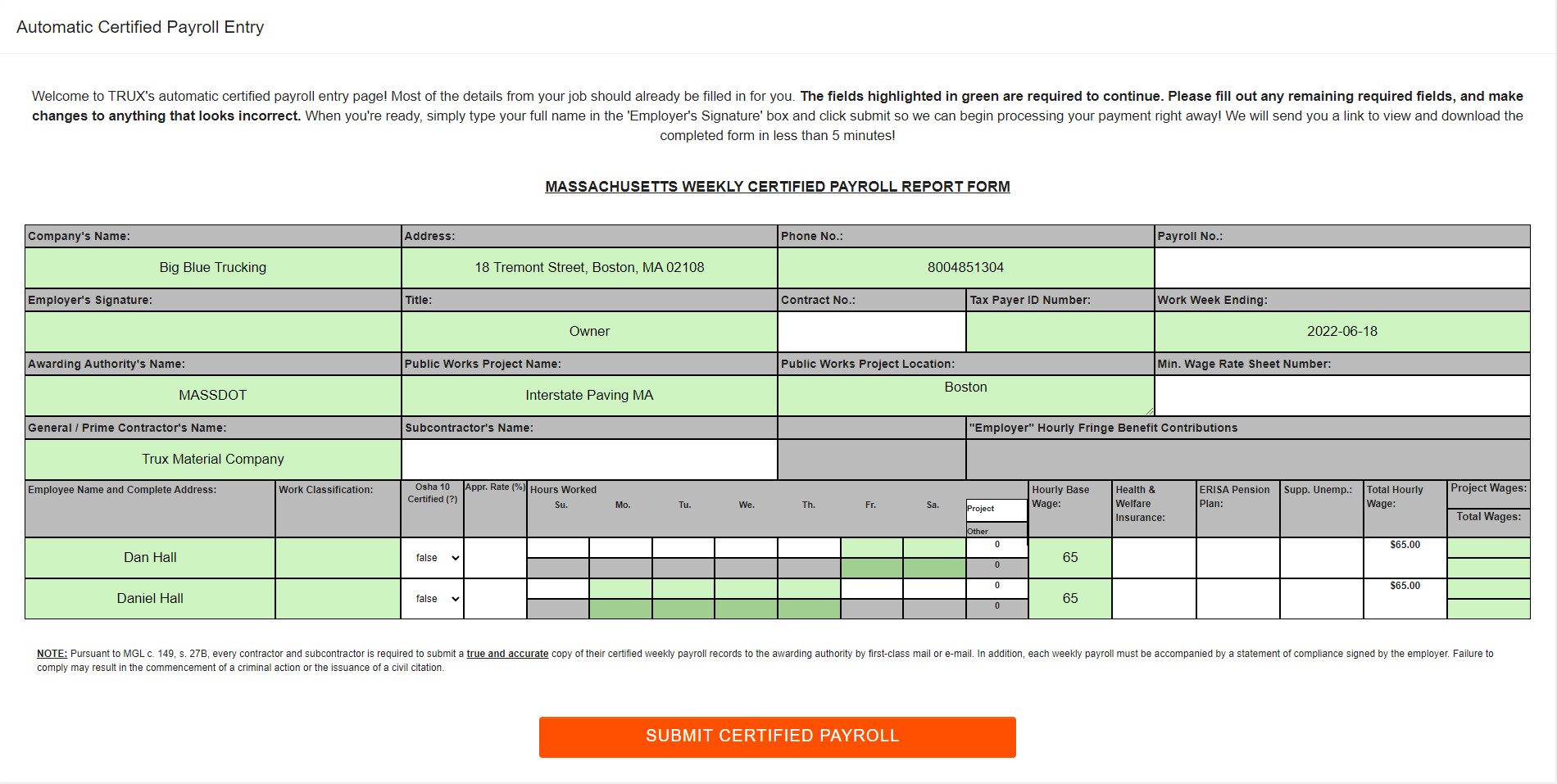

- Certified Payroll

Similar to the Statement of compliance all of the Green Boxes must be filled out in order to submit your prevailing wage, a lot of information has already been populated from the platform but there will be information we need from you:

Employer’s Signature: as the Truck Owner type your name into this field.

Tax Payer ID Number: This is where you would put your Tax ID, similar to filling out your W 9.

Work Classification: this is the Type of work performed on the Project.

Hours Worked: In this section fill out the highlighted days with your hours worked in the top row, In Massachusetts Prevailing wage hours account for the time the hauler spent on the Jobsite.( Ex. if you worked an 8 hour shift but were only on the job site for 2 hours you would record the 2 Prevailing wage hours).

Project Wages/ Total Wages: Multiply the Hours worked by the Prevailing wage Rate.

After you finish filling out all of the required information click the submit button and you will be all set with your Prevailing Wage Documents.

Rhode Island Prevailing Wage

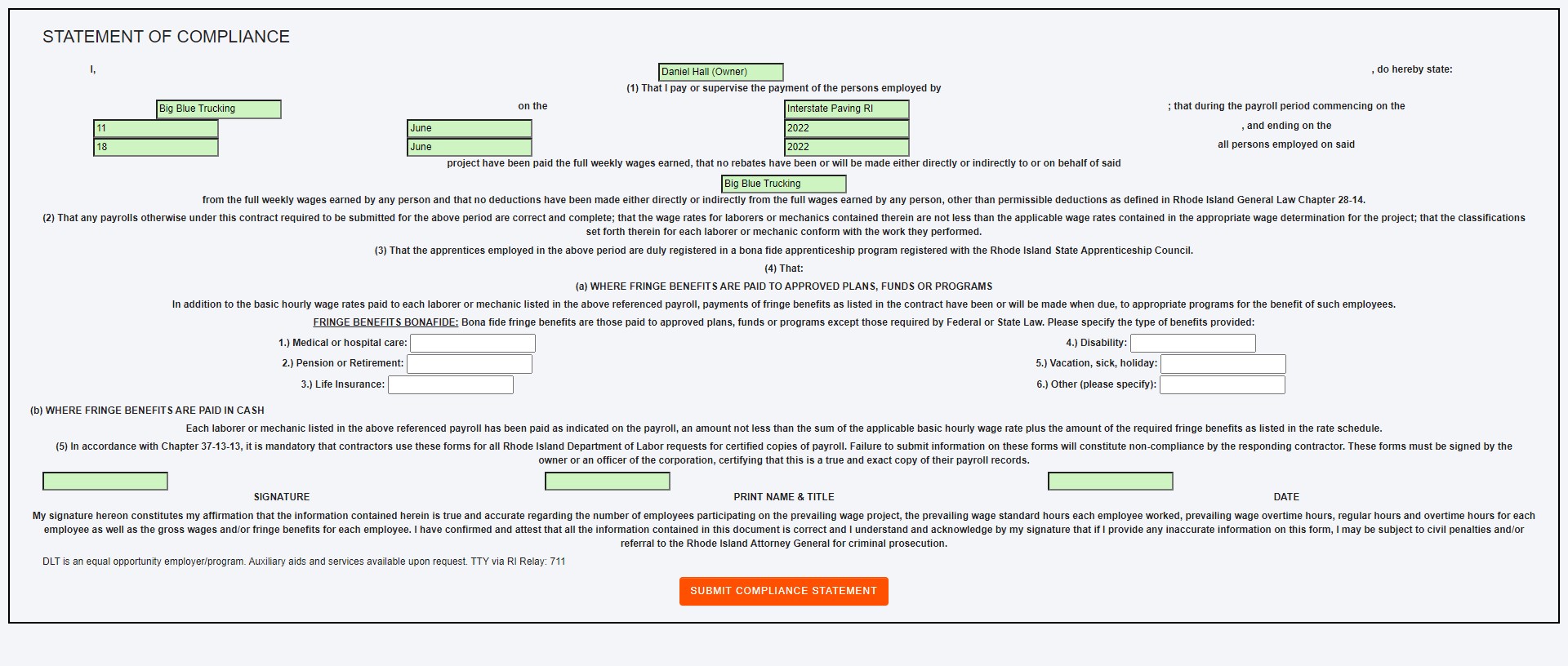

- Statement of Compliance

For the Rhode Island Statement of Compliance all boxes must be filled out in order to submit, Trux will pull most of the information from the Trux app, leaving only the signature, name, and Date to be filled out by you.

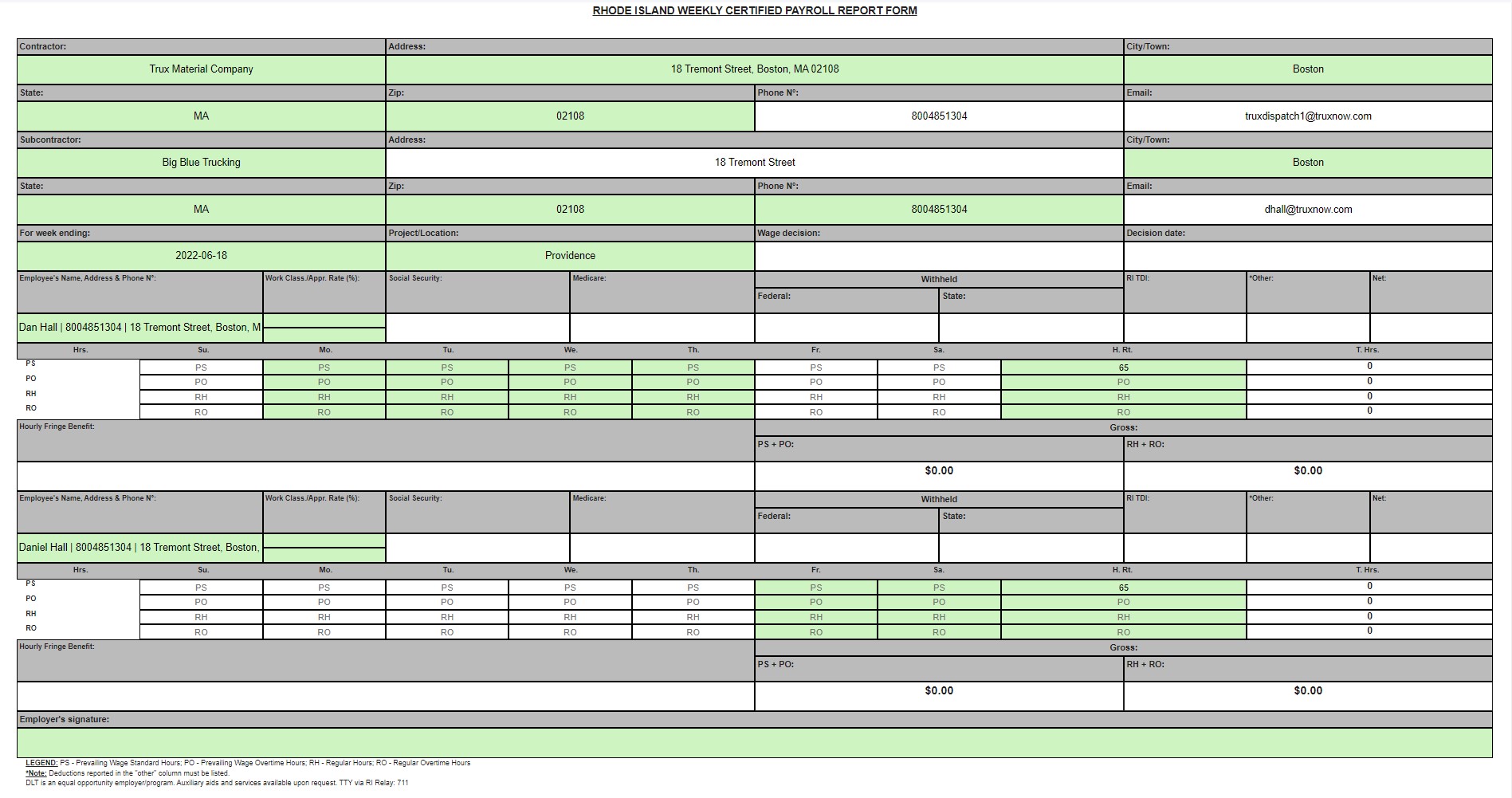

- Certified Payroll

As with the Statement of Compliance All of the green boxes must be filled out before submitting the document. A majority of the information on the document will be pulled directly from the App, you will need to fill out:

Work Classification: The type of work performed on the project

Apprentice Rate: You Should be able to locate this information on the Rhode Island Website https://dlt.ri.gov/

Work Hours: Rhode Island any hours worked on the project fall under Prevailing Wage (ex. On an 8 hour shift all 8 hours full under prevailing wage) On the Prevailing Wage form you will see the following options:

PS- Prevailing Wage Standard Hours

PO- Prevailing Wage Overtime Hours

RH- Regular Hours

RO- Regular Overtime Hours

The Prevailing Wage hours on the job must be marked in the PS boxes

Employer’s Signature: Sign the document here

After you complete the form you will be able to click the submit button and finish your documents.

Comments

0 comments

Please sign in to leave a comment.